- Trading 2025

- Cryptocurrency trends

- ESG investing

- Algorithmic trading

- Retail trading

- Decentralized finance

- Future of markets

Trading 2025: How AI and Geopolitics Will Reshape Global Markets

The landscape of global trading is evolving at an unprecedented pace, driven by advancements in artificial intelligence, shifting geopolitical alliances, and the rise of decentralized finance. As we approach 2025, traders and investors must adapt to a new era of opportunities and challenges. Here’s what to expect in the world of trading next year.

1.AI-Driven Trading Strategies :

Artificial intelligence is no longer a tool for the elite—it’s becoming the backbone of modern trading. In 2025, AI algorithms will analyze vast datasets in real-time, predicting market movements with unparalleled accuracy. From sentiment analysis to automated execution, AI will empower retail and institutional traders alike to make data-driven decisions.

2. The Crypto Revolution Intensifies :

Cryptocurrencies will continue to disrupt traditional financial systems. With regulatory frameworks solidifying and institutional adoption growing, assets like Bitcoin, Ethereum, and emerging DeFi tokens will play a central role in portfolio diversification. NFTs and tokenized assets may also create new avenues for investment.

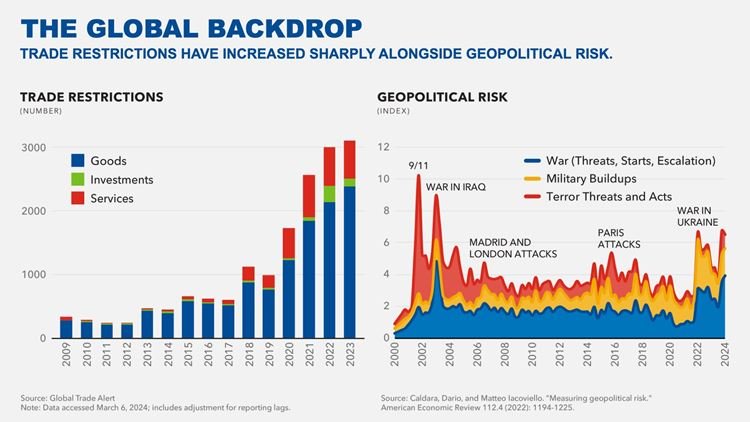

3. Geopolitical Volatility :

Trade wars, energy transitions, and shifting global alliances will inject volatility into markets. Traders must keep a close watch on policies impacting commodities, currencies, and international supply chains. Regions like Asia and the Middle East will emerge as pivotal players in shaping market trends.

4. Sustainable and ESG Investing :

Environmental, Social, and Governance (ESG) criteria will dominate investment strategies. Companies aligned with sustainability goals will attract capital, while those failing to adapt may face divestment. Green bonds, carbon credits, and clean energy stocks will see increased traction.

5. Quantum Computing’s Role :

While still in its infancy, quantum computing will begin influencing high-frequency trading and encryption systems. Its potential to solve complex financial models could redefine risk management and algorithmic trading.

6. Retail Trading Evolution :

Social media and fintech platforms will further democratize trading. Communities on Reddit, TikTok, and dedicated apps will drive retail-driven market movements, mimicking the GameStop phenomenon of 2021.

Preparing for 2025: Key Takeaways

- Embrace AI tools for predictive analytics and automation

- Diversify into cryptocurrencies and decentralized finance

- Monitor geopolitical developments for risk management

- Align portfolios with sustainable and ESG trends

- Stay informed through communities and real-time data platforms

The traders who thrive in 2025 will be those who blend technological adoption with strategic foresight. The future of trading is here—adaptive, interconnected, and driven by innovation.

Conclusion:

As we approach 2025, the trading landscape stands at the intersection of technological innovation and global transformation. AI-driven strategies, cryptocurrency integration, and sustainable investing are no longer future concepts—they are today’s essential tools. Success will belong to those who adapt to algorithmic precision, embrace digital assets, and navigate geopolitical shifts with informed agility.

Question :

How are you preparing your portfolio for increased geopolitical volatility in the coming year?